Multiple Choice О Debit Cash $68,850; debit Loss on Sale of Investment $6,420; credit Equity Method Investments $75,270. О Debit Cash $68,850; credit Gain on Sale of Stock Investment $12,750; credit Equity Method Investments $81,600. Debit Cash $68,850; credit Gain on Sale of Stock Investment $12,750; credit Equity Method Investments $56,100.

Multiple Choice О Debit Cash $68,850; debit Loss on Sale of Investment $6,420; credit Equity Method Investments $75,270. О Debit Cash $68,850; credit Gain on Sale of Stock Investment $12,750; credit Equity Method Investments $81,600. Debit Cash $68,850; credit Gain on Sale of Stock Investment $12,750; credit Equity Method Investments $56,100.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter13: Earnings Per Share (eps)

Section: Chapter Questions

Problem 1R: Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8%...

Related questions

Question

None

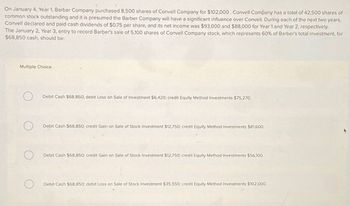

Transcribed Image Text:On January 4, Year 1, Barber Company purchased 8,500 shares of Convell Company for $102,000. Convell Company has a total of 42,500 shares of

common stock outstanding and it is presumed the Barber Company will have a significant influence over Convell. During each of the next two years,

Convell declared and paid cash dividends of $0.75 per share, and its net income was $93,000 and $88,000 for Year 1 and Year 2, respectively.

The January 2, Year 3, entry to record Barber's sale of 5,100 shares of Convell Company stock, which represents 60% of Barber's total investment, for

$68,850 cash, should be:

Multiple Choice

О

Debit Cash $68,850; debit Loss on Sale of Investment $6,420; credit Equity Method Investments $75,270.

О

Debit Cash $68,850; credit Gain on Sale of Stock Investment $12,750; credit Equity Method Investments $81,600.

Debit Cash $68,850; credit Gain on Sale of Stock Investment $12,750; credit Equity Method Investments $56,100.

Debit Cash $68,850; debit Loss on Sale of Stock Investment $35,550; credit Equity Method Investments $102,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning