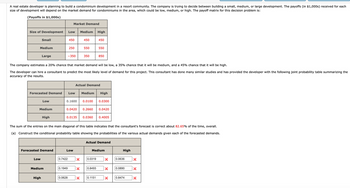

A real estate developer is planning to build a condominium development in a resort community. The company is trying to decide between building a small, medium, or large development. The payoffs (in $1,000s) received for each size of development will depend on the market demand for condominiums in the area, which could be low, medium, or high. The payoff matrix for this decision problem is: (Payoffs in $1,000s) Market Demand Size of Development Low Medium High Small 450 450 450 Medium 250 550 550 Large -350 350 850 The company estimates a 20% chance that market demand will be low, a 35% chance that it will be medium, and a 45% chance that it will be high. The developer can hire a consultant to predict the most likely level of demand for this project. This consultant has done many similar studies and has provided the developer with the following joint probability table summarizing th accuracy of the results. Forecasted Demand Low Low Medium Actual Demand Medium High 0.1600 0.0100 0.0300 0.0420 0.2660 0.0420 High 0.0135 0.0360 0.4005 The sum of the entries on the main diagonal of this table indicates that the consultant's forecast is correct about 82.65% of the time, overall. (a) Construct the conditional probability table showing the probabilities of the various actual demands given each of the forecasted demands. Actual Demand Forecasted Demand Low Medium High Low 0.7422 × 0.0319 0.0636 x Medium 0.1949 × 0.8493 0.0890 High 0.0628 × 0.1151 x 0.8474

A real estate developer is planning to build a condominium development in a resort community. The company is trying to decide between building a small, medium, or large development. The payoffs (in $1,000s) received for each size of development will depend on the market demand for condominiums in the area, which could be low, medium, or high. The payoff matrix for this decision problem is: (Payoffs in $1,000s) Market Demand Size of Development Low Medium High Small 450 450 450 Medium 250 550 550 Large -350 350 850 The company estimates a 20% chance that market demand will be low, a 35% chance that it will be medium, and a 45% chance that it will be high. The developer can hire a consultant to predict the most likely level of demand for this project. This consultant has done many similar studies and has provided the developer with the following joint probability table summarizing th accuracy of the results. Forecasted Demand Low Low Medium Actual Demand Medium High 0.1600 0.0100 0.0300 0.0420 0.2660 0.0420 High 0.0135 0.0360 0.4005 The sum of the entries on the main diagonal of this table indicates that the consultant's forecast is correct about 82.65% of the time, overall. (a) Construct the conditional probability table showing the probabilities of the various actual demands given each of the forecasted demands. Actual Demand Forecasted Demand Low Medium High Low 0.7422 × 0.0319 0.0636 x Medium 0.1949 × 0.8493 0.0890 High 0.0628 × 0.1151 x 0.8474

College Algebra (MindTap Course List)

12th Edition

ISBN:9781305652231

Author:R. David Gustafson, Jeff Hughes

Publisher:R. David Gustafson, Jeff Hughes

Chapter6: Linear Systems

Section6.2: Guassian Elimination And Matrix Methods

Problem 88E

Related questions

Question

Plese, answer me immediately

Transcribed Image Text:A real estate developer is planning to build a condominium development in a resort community. The company is trying to decide between building a small, medium, or large development. The payoffs (in $1,000s) received for each

size of development will depend on the market demand for condominiums in the area, which could be low, medium, or high. The payoff matrix for this decision problem is:

(Payoffs in $1,000s)

Market Demand

Size of Development

Low Medium

High

Small

450

450

450

Medium

250

550

550

Large

-350

350

850

The company estimates a 20% chance that market demand will be low, a 35% chance that it will be medium, and a 45% chance that it will be high.

The developer can hire a consultant to predict the most likely level of demand for this project. This consultant has done many similar studies and has provided the developer with the following joint probability table summarizing the

accuracy of the results.

Actual Demand

Forecasted Demand

Low

Medium

High

Low

0.1600

0.0100 0.0300

Medium

0.0420

0.2660

0.0420

High

0.0135 0.0360 0.4005

The sum of the entries on the main diagonal of this table indicates that the consultant's forecast is correct about 82.65% of the time, overall.

(a) Construct the conditional probability table showing the probabilities of the various actual demands given each of the forecasted demands.

Actual Demand

Forecasted Demand

Low

Medium

High

Low

0.7422

×

0.0319

×

0.0636

×

Medium

0.1949

×

0.8493

×

0.0890

×

High

0.0628

×

0.1151

×

0.8474

×

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Recommended textbooks for you

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning