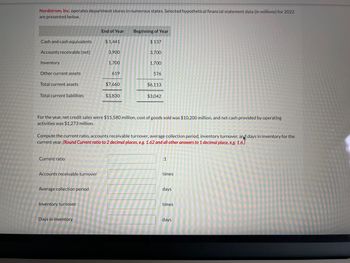

Nordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2022 are presented below. End of Year Beginning of Year Cash and cash equivalents $1,441 $ 137 Accounts receivable (net) 3,900 3,700 Inventory 1,700 1,700 Other current assets 619 576 Total current assets $7,660 $6,113 Total current liabilities $3,830 $3,042 For the year, net credit sales were $15,580 million, cost of goods sold was $10,200 million, and net cash provided by operating activities was $1,273 million. Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round Current ratio to 2 decimal places, e.g. 1.62 and all other answers to 1 decimal place, e.g. 1.6.) Current ratio Accounts receivable turnover Average collection period Inventory turnover Days in inventory :1 times days times days

Nordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2022 are presented below. End of Year Beginning of Year Cash and cash equivalents $1,441 $ 137 Accounts receivable (net) 3,900 3,700 Inventory 1,700 1,700 Other current assets 619 576 Total current assets $7,660 $6,113 Total current liabilities $3,830 $3,042 For the year, net credit sales were $15,580 million, cost of goods sold was $10,200 million, and net cash provided by operating activities was $1,273 million. Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round Current ratio to 2 decimal places, e.g. 1.62 and all other answers to 1 decimal place, e.g. 1.6.) Current ratio Accounts receivable turnover Average collection period Inventory turnover Days in inventory :1 times days times days

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 10EB: Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts...

Related questions

Question

Transcribed Image Text:Nordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2022

are presented below.

End of Year

Beginning of Year

Cash and cash equivalents

$ 1,441

$137

Accounts receivable (net)

3,900

3,700

Inventory

1,700

1,700

Other current assets

619

576

Total current assets

$7,660

$6,113

Total current liabilities

$3,830

$3,042

For the year, net credit sales were $15,580 million, cost of goods sold was $10,200 million, and net cash provided by operating

activities was $1,273 million.

Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the

current year. (Round Current ratio to 2 decimal places, e.g. 1.62 and all other answers to 1 decimal place, e.g. 1.6.)

Current ratio

Accounts receivable turnover

Average collection period

Inventory turnover

Days in inventory

:1

times

days

times

days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning